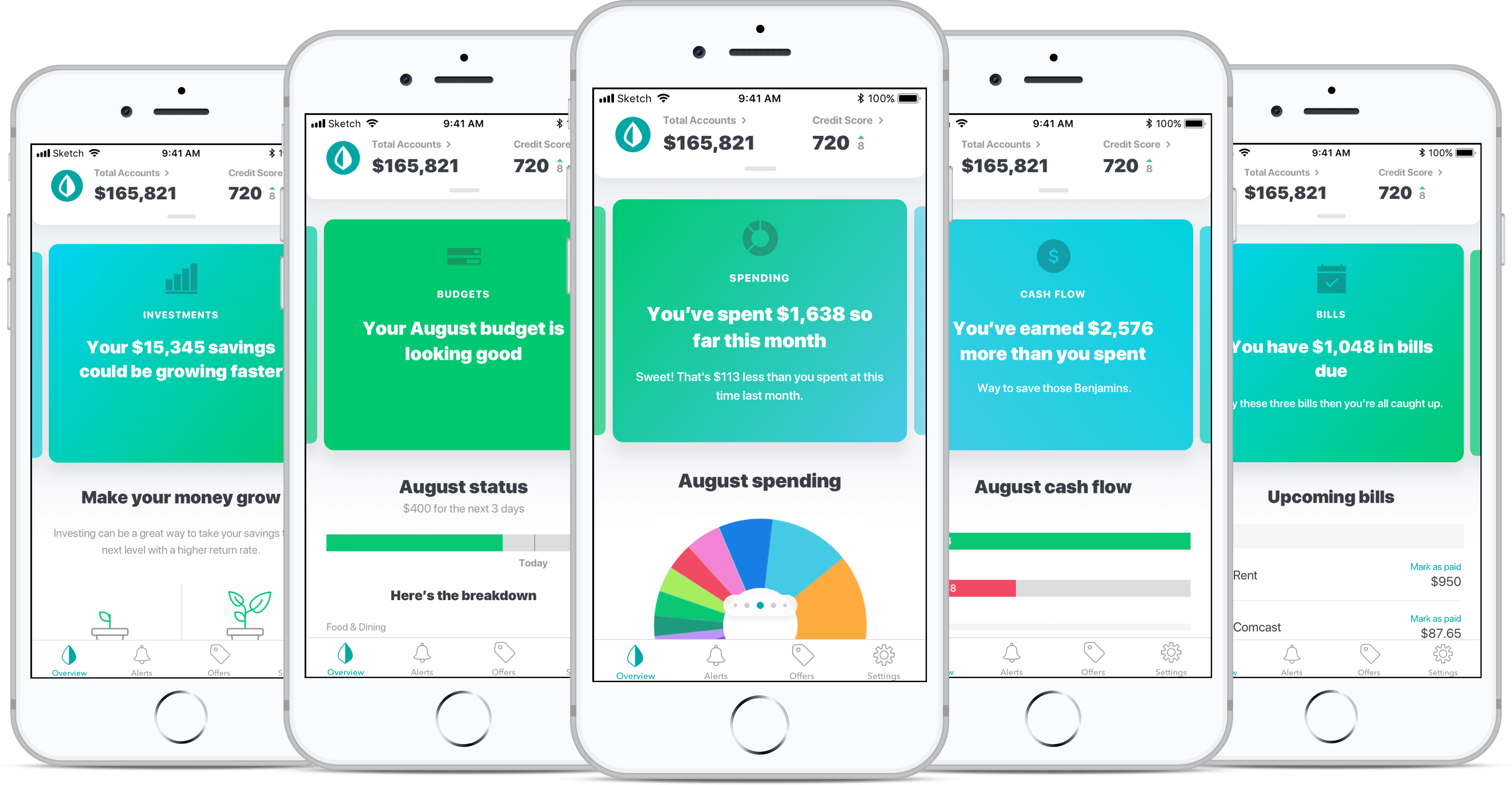

Announcement: Mint Has a Fresh New Look on iOS

[ad_1] We know you love Mint, and Mint loves you right back. That’s why we’re updating the iOS app with a refreshed look and feel that features a sleek design, added benefits, and a simplified view of what’s important with your money. This month, Mint is rolling out a new app experience for iPhone users, featuring exclusive data-driven Mintsights to help existing (and new!) users effortlessly stay on top of their savings, expenses and budgeting. The refreshed app will intelligently use all of your financial data to unlock powerful money insights and money-saving offers and will be available to all Mint...

Continue reading